Nse: Kopran, Kopran Ltd. Is a maintaining corporation, which engages within the production of pharmaceuticals and associated products. It operates thru the subsequent business units: Formulations, and Active Pharmaceutical Ingredients. The company’s merchandise consist of Amyn, Lokit, and Ciproquin. The corporation became based on April 26, 1958 and is situated in Mumbai, India.

Table of Contents

About NSE: KOPRAN LTD

ISIN Sector

INE082A01010 Health Technology

Industry Website

Pharmaceuticals: Major kopran.com

Headquarters Employees

Mumbai 678

Founded

1958

Nse: Kopran Ltd

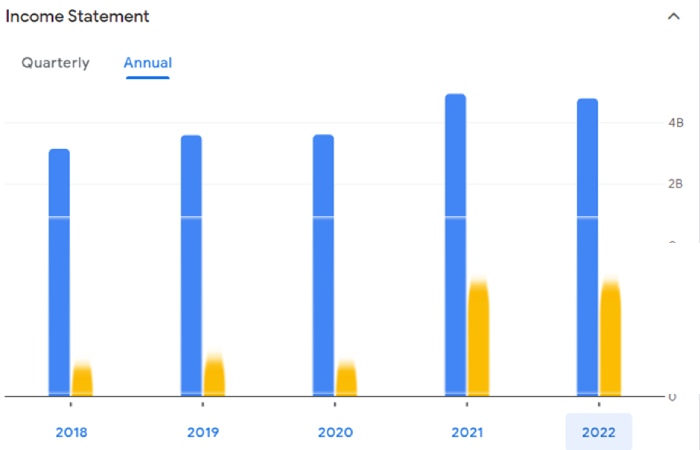

Financials

(INR)2022info

FISCAL YEAR ENDED 3/31/2022.

Y/Y CHANGE

Revenue/Income

Total sum of income generated by the sale of goods or services related to the company’s primary operations

4.78B-2.91%

Operating cost

Represents the total experienced expenses through normal operations

1.26B9.87%

Net revenue

Corporation’s earnings for a period net of operating costs, taxes, and interest

610.31M-0.93%

Net income turnover profit

Measures how much net amount or profit is generated as a percentage of revenue.

12.782.00%

Earnings income pershare

Represents the corporation’s profit separated by the out’standing shares of its common stock.

——

EBITDA

Incomes before interest, taxes, depreciation, and amortization, is a measure of a organisation’s general economic overall performance and is used as an alternative to net profits in a few circumstances

872.95M6.45%

Effective tax rates

The percent of their income that a company pays in taxes

25.37%—

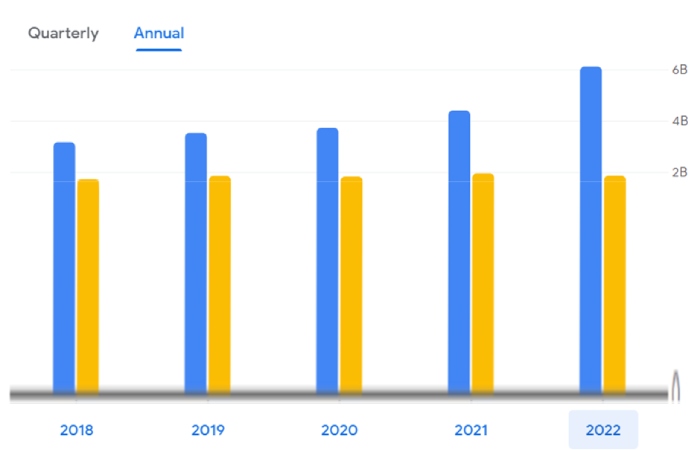

Balance Sheet

Total assets

Total liabilities

| (INR) | 2022info

FISCAL YEAR ENDED 3/31/2022. |

Y/Y CHANGE |

| Cash and short-term investment

Investment’s that are relatively liquid and have maturities between 3 months and one year |

58.68M | 527.42% |

| Total asset

The full amount of assets owned by a company |

6.11B | 39.03% |

| Total charges

Sum of the joint debts a company owes |

1.85B | -4.96% |

| Total evenhandedness

The worth of subtracting the total liabilities from the total assets of a company |

4.26B | — |

| Shares outstanding’s

Total number’s of common shares outstanding as of the latest date disclosed in a financial filing |

48.21M | — |

| Price to volume

A ratio use to determine if a company’s market value is in line with the value of its assets less liabilities and preferred stock |

1.64 | — |

| Return on asset’s

A financial ratio that shows a companys profitability compared to its assets |

9.15% | — |

| Returns on capetal

Company’s returns above the average cost it pays for its debt and equity capital |

11.84% | — |

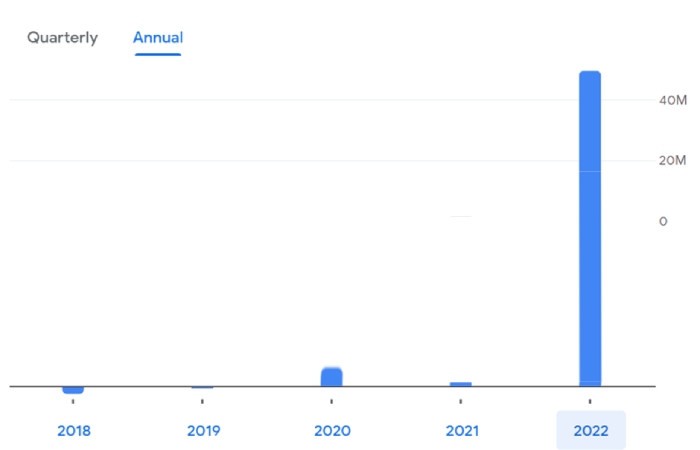

Cash Flow

Net change in cash

| (INR) | 2022info

FISCAL YEAR ENDED 3/31/2022. |

Y/Y CHANGE |

| Net revenue

Corporation’s earnings for a period net of operating costs, taxes, and interest |

610.31M | -0.93% |

| Money from processes

Net cash use or generated for core business activities |

-334.75M | -155.84% |

| Cash from investments

Net cash use or generated in investing activities such as purchasing assets |

-844.15M | -233.93% |

| Cash from funding

Net cash use or generated in financing activities such as dividend payments and loans |

1.23B | 455.28% |

| Net changes in money

The amount by which a corporation’s cash balance increases or decreases in an accounting period |

49.33M | 4,793.85% |

| Free cash movement

Volume of cash a business has after it has met its financial obligations such as debt and outstanding payments |

-1.38B | -2,819.06% |

Stocks

Ownership of a fragment of a organization and the right to assert a percentage of the organization’s belongings and income equal to the amount of stock owned

IN listed security

Listed on NSE

IN headquartered

Headquartered in India

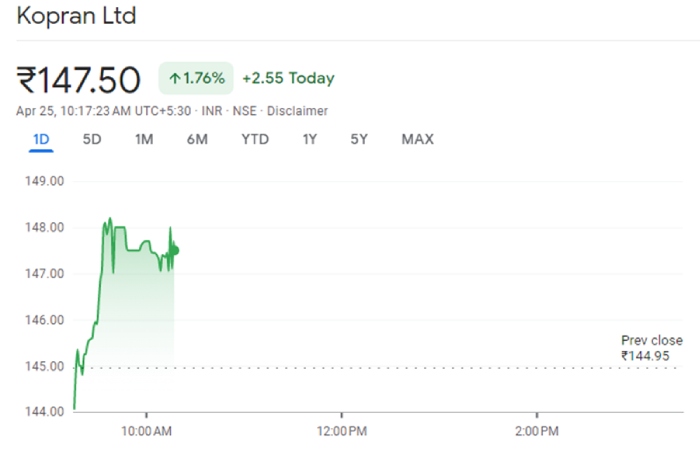

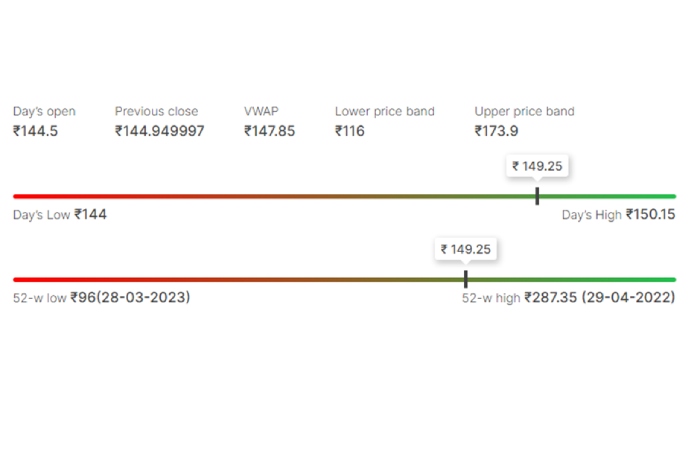

PREVIOUS CLOSE

The last closing price

₹144.95

DAY amount

The amount between the high and low prices over the past day

₹144.00 – ₹149.00

YEAR Amount

The amount between the high and low prices over the past 52 weeks

₹96.00 – ₹287.35

MARKET-CAP

A estimation method that multiplies the price of a company’s stock by the total number of outstanding shares.

7.12B INR

P/E SHARE

The ratio of present share price to trailing 12 month EPS that signals if the price is high or low compared to other stocks

19.23

BONUS YIELD

The ratio of annual bonus to current share price that estimates the dividend return of a stock

2.03%

PRIMARY EXCHANGE

Listed exchange for this security

NSE

Price info of Nse: Kopran Ltd

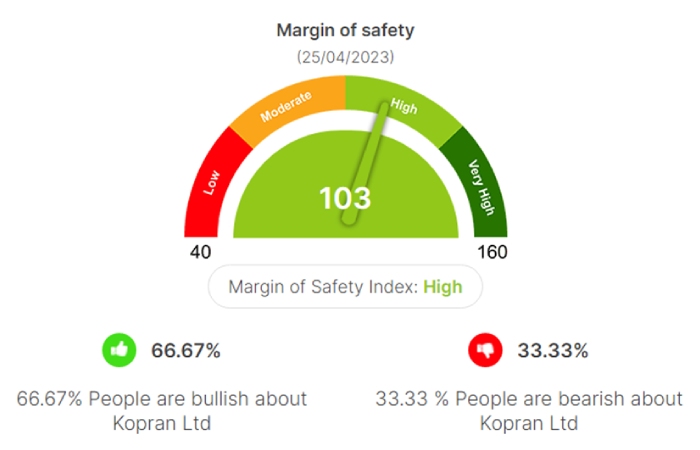

Margin & Trade Information of Nse: Kopran Ltd

- Traded Volume

69,724 (Shares)

- Traded Value

₹ 10,308,693.83

| VAR Margin | | | ELM Margin | | | Adhoc | | | Total Margin |

| 21.85 | + | 3.50 | + | 24.65 | = | 50 |

Quick Overview of Kopran Ltd

| Market Cap (Cr): 891 | Face Value (₹): 10 | EPS (₹): 13.8 |

| Book Value (₹): 88.4 | Roce (%): 21.4 | Debt to Equity: 0.20 |

| Stock P/E: 14.3 | ROE (%): 18.2 | Dividend Yield (%): 1.62 |

| Revenue (Cr): 475 | Earnings (Cr): 80 | Cash (Cr): 57 |

| Total Debt (Cr): 75 | Promoter’s Holdings (%): 43.78 |

Valuation Analysis of Kopran Ltd

Today’s Market Action

The last traded share price of Nse: Kopran Ltd was 149.25 up by 2.97% on the NSE. It’s last traded stock price on BSE was 149.35 up by 2.82%. The total size of shares on NSE and BSE mutual was 79,010 shares. Its total combined turnover was Rs 1.17 crores.

Medium and Long Term Market Action

Kopran Ltd hit a 52-week high of 287.35 on 29-04-2022 and a 52-week low of 96 on 28-03-2023. The stock price of Nse: Kopran Ltd is up by 43% over the last one month. It is down by -47.4% over the last one year.

Related Searches

kopran share price target

kopran pharma share price

Nse: kopran Results

kopran share price target 2023

kopran news today

Nse: kopran share price target 2025

kopran pharma product list

kopran share price target tomorrow