In this SGX: S68 series, we feature one Singapore-listed company each time as a quick guide to everything you should know about it in 60 seconds.

Right here, we have Singapore Exchange Limited (SGX: S68) (SGX), Singapore’s only stock market operator.

Table of Contents

What’s SGX: S68 Business About?

SGX runs the infrastructure that allows people to buy and sell shares, real estate investment trusts (REITs), exchange-traded funds (ETFs), bonds, and derivatives, among other things.

The company prides itself in being the “most liquid international market for pan-Asian listed derivatives” and the most international stock exchange in Asia.

SGX has three main business divisions:

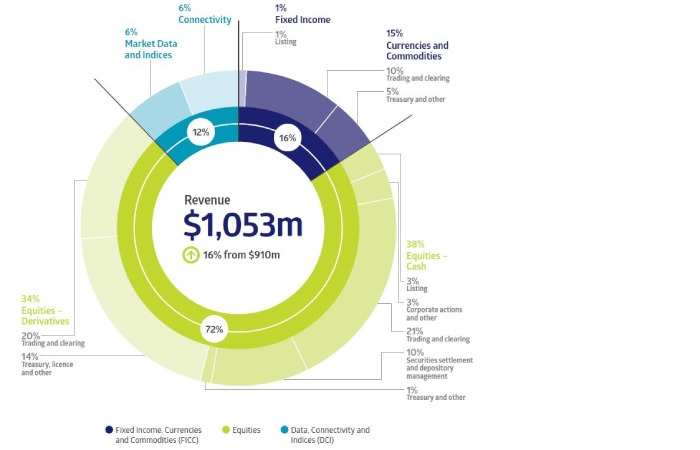

- Fixed Income, Currencies and Commodities (FICC)

- Equities

- Data, Connectivity and Indices (DCI)

The FICC segment provides fixed income issuer services, trading and clearing services and collateral management.

Revenue from the Equities segment comes from providing securities trading and clearing, securities settlement and depository management, and derivatives trading.

Last but not the least, the DCI segment provides market data, connectivity and indices services.

Pictorially, the following is how SGX’s FY2020 (financial year ended 30 June 2020) revenue can be broken down:

SGX: S68 Stock Overview

SGX: S68 Singapore Exchange Limited, together with its subsidiaries, operates as an integrated securities and derivatives exchange, and associated clearing homes in Singapore.

REWARDS

Earnings are forecast to grow 3.08% in step with yr

Earnings grew via 21.Nine% over the past year

Pays a reliable dividend of 3.36%

Singapore Exchange Limited Competitors

Singapore Exchange Limited Competitors

SGX: S68 Financial Highlights

Being the only stock market operator in Singapore, anyone who wishes to trade shares has to go through SGX; there’re no two ways about it.

Also, with a broad range of derivatives being offered, SGX can tap into the rapidly growing derivatives market.

Therefore, it is not surprising to see SGX performing well financially over the years:

| FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | FY2020 | |

| Revenue (S$ million) | 779 | 818 | 801 | 845 | 910 | 1,053 |

| Net profit (S$ million) | 349 | 349 | 340 | 363 | 391 | 472 |

| Net profit margin | 45% | 43% | 42% | 43% | 43% | 45% |

| Return on equity | 37% | 36% | 34% | 34% | 36% | 40% |

| Earnings per share (cents) | 32.6 | 32.6 | 31.7 | 33.9 | 36.5 | 44.1 |

| Operating cash flow per share (cents) | 40.1 | 39.6 | 35.3 | 39.9 | 39.0 | 58.3 |

Due to its wide economic moat, SGX has an enviable net profit margin and return on equity (ROE). The net profit margin shows how much a business gets to keep for every dollar of revenue generated while the ROE figure reveals how efficient SGX’s management is in turning every dollar of shareholders’ money into profit.

For FY2020, SGX clocked in a net profit margin of 45% and an ROE of 40%. Both figures are higher than what most companies in Singapore’s stock market can achieve.

SGX’s balance sheet is also rock-solid. As of 30 June 2020, its cash balance stood at S$907 million with just S$300 million in bank borrowings.

SGX: S68 Dividend History

Since the start of FY2019, SGX revised its dividend policy, as mentioned in an earnings release:

For FY2020, SGX paid out 30.5 Singapore cents per share. From FY2021 onwards, the stock exchange will raise its dividend to 32 cents per share.

| Year | Dividend per share (Singapore cents) |

| FY2015 | 28 |

| FY2016 | 28 |

| FY2017 | 28 |

| FY2018 | 30 |

| FY2019 | 30 |

| FY2020 | 30.5 |

Major Risk for SGX: S68 to Take Note Of

One main downside with SGX would be its inability to attract home-grown companies to list in Singapore.

Examples of prominent firms listing elsewhere include Razer Inc (HKG: 1337) and Sea Ltd (NYSE: SE), which recently won the digital banking license here.

However, SGX’s other businesses, such as derivatives, are holding up the fort.

SGX’s (SGX: S68) Share Price and Valuation

Over the past five years, SGX’s share price has climbed 29% in all.

At SGX: S68 current share price of S$9.58, it has a price-to-earnings (P/E) ratio of around 22 and a trailing dividend yield of 3.2%.

Want to Discuss Further?

Why not check out our community at Seedly and participate in the discussion surrounding stocks like Singapore Exchange Limited (SGX: S68) and many more!

Disclaimer: The information that follows Serves as an academic piece and is not meant to be personalized funding recommendation. Readers must constantly do their personal due diligence and recollect their financial desires before investing in any inventory. The writer might also have a vested interest within the organization noted.

Complete evolution of SGX-Nifty derivatives contracts to SGX-Connect from July 3, 2023

The SGX: S68 will be suspended from trading after the end of the T session on June 30, 2023.

Announcing the overall-scale operation of NSE IFSC-SGX Connect at GIFT City, Gandhinagar, the Singapore Exchange SGX: S68 on Monday issued a round to its market participants pointing out that a full-fledged liquidity transfer may be made powerful from July three, 2k23, from SGX: S68

to the National Stocks Exchange of India (NSE)‘s sgx: s68 IFSC-SGX Connect.

“Full-scale process of the NSE IFSC-SGX Connect (Connect) with the transition of SGX Nifty derivatives to NSE IFSC will take area on three July 2023. Following the transition, all US greenback denominated Nifty derivatives contracts might be exclusively traded on NSE IFSC,” a word on the SGX Nifty Derivatives stated Monday.

It also delivered that during executing the Liquidity Switch, SGX: S68 will routinely migrate all open positions in SGX NIFTY after the stop of the T consultation, and which aren’t netted off-in put up-change, on June 30, 2023, to NSE IFSC NIFTY.

Those market individuals who do now not desire to have their SGX NIFTY migrated to NSE IFSC NIFTY via SGX have to near out the open positions in SGX NIFTY or perform the switch themselves through open marketplace buying and selling, before the quit of the T session on June 30, 2023, in an orderly way, it said.

With the migration of all open positions in SGX NIFTY to NSE IFSC NIFTY, no open hobby will remain in SGX NIFTY. The SGX NIFTY could be suspended from buying and selling after the quit of the T session on 30 June 2023, the round said, including that SGX intends to delist the SGX NIFTY at a later date, pending due regulatory system.

Conclusion

The SGX: S68 positions might be transformed to NSE IFSC NIFTY positions based on a conversion ratio of one:1. Each new NSE IFSC NIFTY role could be equivalent to one unique SGX NIFTY function.

SGX will waive all applicable clearing and position switch fees for the SGX: S68 and NSE IFSC NIFTY in this Liquidity Switch, the SGX circular said.

“For avoidance of hesitation, the buying and selling classes, timings for NLT, and publish-exchange sports for NSE IFSC NIFTY could be business as typical,” the round delivered.